By Carri P. Jenkins

On April 10, 1994, Lee Tom Perry and Eric L. Denna presented to the Executive Committee of Scott Paper Co. what they believed to be a strategic, carefully mapped-out plan that would save Scott’s human resources and payroll departments millions of dollars.Scott’s executives applauded the two Marriott School of Management professors and gave them the green light to implement their plan. Then Scott’s president, Jack Butler, asked Perry and Denna to take on a new project–the redesign of Scott’s procurement and payment processes–again with the goal of tightening the company’s financial belt.

Twelve days later, however, Perry and Denna’s involvement with Scott Paper came to a crashing halt. As consultants, they were no longer needed because the company’s board of directors had a new plan for cutting costs: Al Dunlap.

The rest of the story is still being told and retold in every magazine from Time to Fortune to Newsweek. Describing Albert J. Dunlap, Business Week reported in January of 1996, he “has won widespread plaudits for transforming Scott from a stodgy, tired underperformer into a profit powerhouse.”

Dunlap’s secret: Cut 11,000 people.

And therein lies the cover story. For a little more than two years’ work, Dunlap received $100 million in salary, bonus, stock gains, and other perks. This from a company so distressed it had to let go of 71 percent of its headquarters staff, according to Business Week.

Justifying his reward, Dunlap simply points to Scott’s successful turn around, which resulted in a $9.4 billion merger with Kimberly Clark Corp.

Critics abound, of course, claiming Scott Paper was cut to the very bone and left without the muscle to compete in a global market. Yet supporters credit Dunlap (who has since left Scott Paper and is at Sunbeam Corp., where last November he announced the company will eliminate half of its 12,000 jobs) with not just saving a dying company but also raising its stock 225 percent.

But this article isn’t about the health of Scott Paper or the persona of Al Dunlap; it’s about the wisdom behind downsizing.

Does Slashing Jobs Work?

“Scott Paper was a crazy place in 1994,” explains Perry, a professor of organizational behavior, who documented welders making six-figure salaries thanks to overtime and watched paperwork in Human Resources go through a 15-step process only to end up in the garbage. “Obviously, something needed to be done. But what bothers me about Al Dunlap is his lack of precision. He has a very simplistic view: smaller is better.”

Is smaller better?

The national verdict, if judged by the recent onslaught of articles and cartoons in the media, would be a resounding no. Labeled as “dumbsizing,” the practice has been attacked as a poor business strategy that benefits only Wall Street and leaves companies too weak to compete. But why then is our economy flourishing and productivity up? And if it truly hurts business, why did researchers find in a recent survey of 2,000 corporate executives in Canada, France, Germany, Japan, the United Kingdom, and the United States, that 94 percent of companies surveyed had engaged in downsizing between 1993 and 1995?

Downsizing has also been accused of destroying the American dream; yet unemployment is relatively low. Downsizing is said to be motivated by greedy CEOs and Wall Street; yet more and more of us depend on our own 401Ks with their stock investments for retirement. Downsizing is reported to leave workers demoralized and depressed; yet transitions, say economists, are always painful.

What then is the real story behind downsizing?

It’s a question researchers at BYU, whether they come from an economics or a sociology background, have been asking for years. Not surprisingly, given all the elements surrounding downsizing–the human toll, the up-and-down nature of our economy, America’s strong belief in capitalism–the professors’ answers do not agree. In fact, some could be described as polar opposites.

“Nobody has all the answers,” says B. Delworth Gardner, a professor emeritus of economics. “And one can’t fully escape from one’s ideology. You see these things from your own prism. That’s why it is important that we hear different points of view.”

Take the first question: Is downsizing nothing more than the redistribution of a company’s resources from the employees to the shareholders? After all, following the cuts, what value has been gained? Then again, if it’s such a stupid strategy, why is productivity up in the United States and why are so many CEOs using it?

Productivity is up, explains Gardner, because capitalism is at work in America. “Competition drives productivity,” he says. “It is competition that forces downsizing–and that’s good. Companies must respond to changes in price, costs, and technology, or they won’t survive. What we are now seeing is that people who are let go are finding other opportunities. We are working right now with record low numbers of unemployment, and incomes are rising because of it. All of us would pay the price if social policy were to impede this.”

Gardner himself knows firsthand the effects of downsizing. Shortly after World War II, his family was forced off their small dairy farm in Wyoming. “So Del had to go off to college and become an economist,” he laughs.

His life’s work, however, has been spent dealing with “agriculture problems.” In the last 25 years, he has watched the number of U.S. farmers go from 13 million to about two million. “The consequence of this to farmers has been great,” he says. “Just as Jessica Lange and Sally Field showed us in the movies, these farmers were hardworking, virtuous people. But the bankers were not evil and uncaring.

“The fact is that in the early ’80s, world markets were such that agricultural prices fell, and farmers suffered huge losses because they could not pay their bills, especially their land mortgages. We also had too many farmers, many of whom were trying to buy equipment they could not afford. And so there was a natural downsizing. If agriculture had not downsized, we would be paying a much larger percent of our income for food. That is the way it is in all other countries.”

Today, says Gardner, many of America’s big corporations, in the face of labor-saving technical advances–like agriculture before–have not kept their labor forces in check and, in order to be efficient and compete, have had to downsize.

“In some ways, this whole controversy goes back to a very fundamental issue: If you believe a capitalist system works well and market competition drives the system, then you see all of this as part of the dynamic nature of change,” says Gardner. “But if you believe it is inefficient and corrupt, then you will see problems.”

What Are the Real Costs?

Kim S. Cameron, a professor of organizational behavior who has spent the last 20 years researching the results of downsizing, says he understands full well the nature of capitalism, but he also understands why many have looked upon today’s cutbacks as “dumbsizing.”

In the health-care field, for instance, researchers in two studies involving 571 hospitals found that patient mortality rates increased by 400 percent when staffs were reduced by 7 percent, says Cameron, adding, “That’s when people ask, ‘What is going on here?'”

Yet Cameron, like Gardner, has come to believe that after years of experiencing a disproportionate expansion in the number of white-collar workers, downsizing has become necessary. “This is illustrated by the fact that in 1950, 23 percent of U.S. manufacturing industry employees were nonproduction workers. By 1988, that figure had risen to 47 percent,” Cameron wrote in a 1991 journal article for the Academy of Management Executive.

Where Cameron lashes out–and he has, calling “downsizing the most pervasive yet unsuccessful change effort in the business world”–is how it is carried out.

“It is most often implemented as a grenade strategy,” he explains. “You throw a grenade into a company, and it explodes, eliminating the positions of a certain number of people. The problem is you have no way of telling precisely who is going to be affected.

“In the end, a corporation almost always loses company memory and company energy. The first is caused when informal networks are destroyed, information sharing is restricted, and experienced employees depart. The second is caused from declining morale, loss of loyalty and commitment, and the departure of the most talented employees, who know they are marketable.”

But despite the negative fallout from downsizing, Cameron adds, “Managers are not dummies.” Particularly since the beginning of the 1990s, he has seen many companies “downsize” in effective and compassionate ways. “The success stories are out there: Mead, Hughes, and Sears Merchandizing Division are a few of them. The key is not one of these companies has used the grenade strategy.

“While the 1980 and early 1990 downsizings almost always focused on head count, CEOs are beginning to look at the big picture, at changing the culture of the organization. If they merely cut positions and head count, but do not address the fundamental problems causing inefficiency and lack of competitiveness, the problems are still going to be there even after downsizing.

“Companies are now realizing that they have to redesign to avoid the problem of overloading fewer workers with the same amount of work using the same organizational arrangements,” Cameron adds. “This type of strategy involves redefining downsizing as a way of life, as an ongoing process, as a basis for continual improvement, rather than as a program or target.”

Even so, Warner P. Woodworth, a professor of organizational behavior who is internationally known for his work in human resources, believes the United States’ high level of productivity is about to topple, taking the American dream with it.

“In the ’70s and ’80s, America finally realized that it had to invest in new equipment, upgrade its technologies, and better train its employees,” he says. “We were playing catch-up to the Japanese and Europeans. And so there was this huge infusion of time and money, as well as attention to our human resources and also to our technical resources. This has led to a big productivity boom.

“But if we continue this simultaneous cutting out of massive amounts of workers, we’re going to see a downturn again.”

Does Upsizing follow Downsizing?

Val Lambson, an associate professor of economics, disagrees with Woodworth, primarily “because the forces causing downsizing in one area are the same ones causing upsizing in others.”

With every change, there are people who are hurt and people who are helped, he says. “But the way capitalism works is that it sends signals through prices, telling people what they ought to be doing based on what’s valued by consumers. The advantage of a free-market system is that it allocates the resources in a productive and efficient way. The results are beneficial for the whole.”

If people who had lost their jobs were not finding new ones, we would be dealing with another matter, says Lambson, opening the Nov. 16 issue of The Economist to the economic indicators page. The unemployment rate for the United States is 5.2. Out of the 15 countries listed, only Japan (3.3) and Switzerland (4.8) are lower.

“The press tends to focus on the people who are losing jobs and not the new jobs that are being created,” he says. “The United States’ unemployment rate is lower than all over Europe. This is because governments in Europe are intervening to make sure that corporations are not too interested in profits and are acting in ‘humanitarian’ ways. As a result, you have double digit unemployment, and that’s not good for the people who are unemployed.

“Here, people are losing jobs in one sector and gaining jobs in others. That’s the way a vibrant, dynamic market economy works. When there’s a technological change, or a change in consumer taste, the changes are reflected in the prices. That’s a signal to industry producers–the black-and-white television industry, for example–to retrain, retool, and move into other areas, which may cause some downsizing. So, you get this flow of labor from where it’s less valued because of the change to where it’s more valued. This is efficient in the sense of maximizing national wealth. That’s good for people. That’s humanitarian. That’s fundamentally moral.”

Herbert Spencer, Charles Darwin’s friend and associate, had the same idea, says Woodworth of the noted sociologist. Both Darwin and Spencer came to the conclusion that the economy, like nature, was in an ongoing struggle for survival. Hence, in order to be efficient, corporations had to continually engage in internal warfare.

Which is exactly, says Woodworth, what he sees happening today.

In the ethics and values class he teaches, Woodworth says he constantly encounters the argument: “We’ve got to downsize because that will make the economy better.”

“And I ask, ‘What does that mean? Why don’t we ask what makes for a better society and not just what makes a successful company?’

“People now see themselves as being cogs in a big machine that is chewing them up. Yes, some eventually get new jobs but usually at less income and without the benefits they once had. In contrast to this, you’ve got the guys at the top whose incomes are soaring through the roof. CEOs of our top 300 companies are making 212 times what their lowest-paid employees are making. In the 1970s, it was 29 to 1. Today, in Japan the ratio between the top- and lowest-paid employees is 16 to 1 and in Germany it is 21 to 1.

“Aristotle argued that the wealthy should never get more than five times what the poor get,” Woodworth continues. “He said there should be a 5 to 1 ratio to have a moral society. And the best-known economist in the world today, Peter Drucker, says it should never be more than 20 to 1. Even J.P. Morgan thought a 20 to 1 ratio or salary differential between a CEO and his workers was the most anyone should ever try to push the boundaries of decency. So it’s no wonder you’ve got more and more Americans feeling like the American dream is beyond their reach–all because of the greed of a few.”

Then how come no one calls it greed when Michael Jordan is offered $30 million in direct salary, asks Gardner? “Is Jordan’s high salary a consequence of greed? No, it’s the way society rewards exceptional and unique talent. It’s exactly the same thing with very rare and talented executives who have to be paid what they are worth.”

AT&T’s Robert Allen, who downsized the company by 40,000 layoffs, was one such talent, Gardner says. “He had the guts to make it more profitable and more competitive, and for that he was rewarded.”

CEOs don’t only downsize to save a company from bankruptcy, adds Lambson, they also do it to make a company more profitable. “If by greed we mean the desire of CEOs is to maximize their profits that later get distributed to their shareholders, then these shareholders–who are people like you and me, saving for retirement–should really want their CEOs to be as greedy as possible. Given the share ownership in the United States, we have to understand that a lot of middle income and even poor people own stock in corporations, either directly or more often through pension funds.”

While, philosophically, all of this may make sense, it doesn’t ease the pain of the BYU engineering graduate who worked 10 successful years for a computer firm only to be pushed out in a merger. After a full year of unemployment, he then found a job at roughly the same level of compensation. And now, two years later, this company has been acquired, and he is being told that he can either leave or take another position at half his salary.

Who Gets Hurt?

Nobody claims downsizings are done with the intent to harm people, but it does seem that any emotion and care for employees go out the window during a systems reduction, says Kyle Lynn Pehrson, director of BYU’s School of Social Work.

As the Reserve social work consultant to the U.S. Army’s Surgeon General, Pehrson has studied extensively the human side of the Army’s recent downsizing. With the end of the Cold War, and in response to pressure to cut federal spending, the army’s personnel force structure will be reduced from 780,000 in uniform to approximately 495,000 by 1998.

Looking specifically at the medical community inside the Army, Pehrson’s research mirrored what is reportedly happening in the corporate world: Downsizing hits hardest those between 50 and 60. “If you get caught inside that window of time, where you are too old to move on and yet too young to retire, it can be an ugly experience.”

For some it’s so ugly they give up–a phenomenon that Pehrson describes as similar to the flight phobia on which he conducted research as a young social work officer. “During Vietnam, we would have combat pilots and crew members who had flown thousands of successful combat missions just announce one day that their number was up and they weren’t going to fly anymore,” he says. “They didn’t want to go back to the risk. It didn’t make sense to them anymore.”

Pehrson puts many of the colonels he interviewed for his study on the army’s downsizing in this same category. “These are people who had flawless records, and now they were being thrown out. And the more they tried to make sense of it, the more it didn’t make sense. In the end, something just clicks inside, and they don’t want to climb anymore. They want to get out of the rat race.

“I’m not trying to argue that this is a pathology–or even something wrong–but it is something that is happening in our very competitive, difficult environment when people don’t feel valued anymore.”

Jeffry H. Larson, a professor of family sciences who has studied downsizing as it relates to marital and family relationships, says it is not just those who lose their jobs who are suffering but also those still on the job.

Such distress comes from several sources, he says: threat of job loss, job description changes, added responsibility due to the layoff of co-workers, salary or benefits freezes or cutbacks, forced relocation, or loss of potential for promotion.

The good news, he says, is people are beginning to adapt. “We are already adjusting to the fact that the American dream has changed. Very few of us will ever see a gold watch for umpteen years of service. In a lot of industries, people just don’t expect to be around a long time. And yet, research shows that job security–What are my chances of retiring from here?–has moved up in importance, second only to pay, in what people value.”

That’s because downsizing, no matter how valid it is, is traumatic to individuals, says Larson, who survived a downsizing at Montana State University in 1992 .

“The university was facing extreme financial difficulties and had been told to eliminate positions in every department possible,” he says. “So I became one of those insecure people. During this time, it occurred to me that we know a lot about the effects of unemployment on individuals and marital and family relations, but what are the effects of job insecurity?”

After surveying 222 employees and their spouses, Larson concluded that job insecurity does have a negative effect on marital satisfaction. “It also has a negative effect on family functioning and satisfaction. And worrying about an impending layoff is probably worse than actually being laid off because you can’t really begin planning for the future.”

Such fear and mistrust, concedes Gardner, are not good for individuals, companies, or the economy. And while corporations are not charitable institutions, he believes it is in the best interest of all for companies to create an environment where employees can thrive. Yet, he cautions, neither companies nor their employees can thrive unless they respond to changing prices and costs.

A Place for Precision

Such was the reason Lee Perry was at Scott Paper in April of 1994. “I’m not sure we could have turned the business around,” he says, “but we could have saved them millions and millions of dollars using technology and redeploying people in different ways.”

A professor of strategy and organizational behavior in the Marriott School of Management, Perry has been lauded for his forward thinking about corporate restructuring and competitive business strategies.

“The whole reason I’m telling you about Scott Paper,” he explains, “is because my logic was so different than Al Dunlap’s. We went in and learned about every process, every subprocess. We mapped each one out, and we redesigned them in a more efficient way. Again, some people would have been redeployed; there was no question about that. And maybe some would have lost their jobs. But our logic was not to go in and cut 15 percent across the board.”

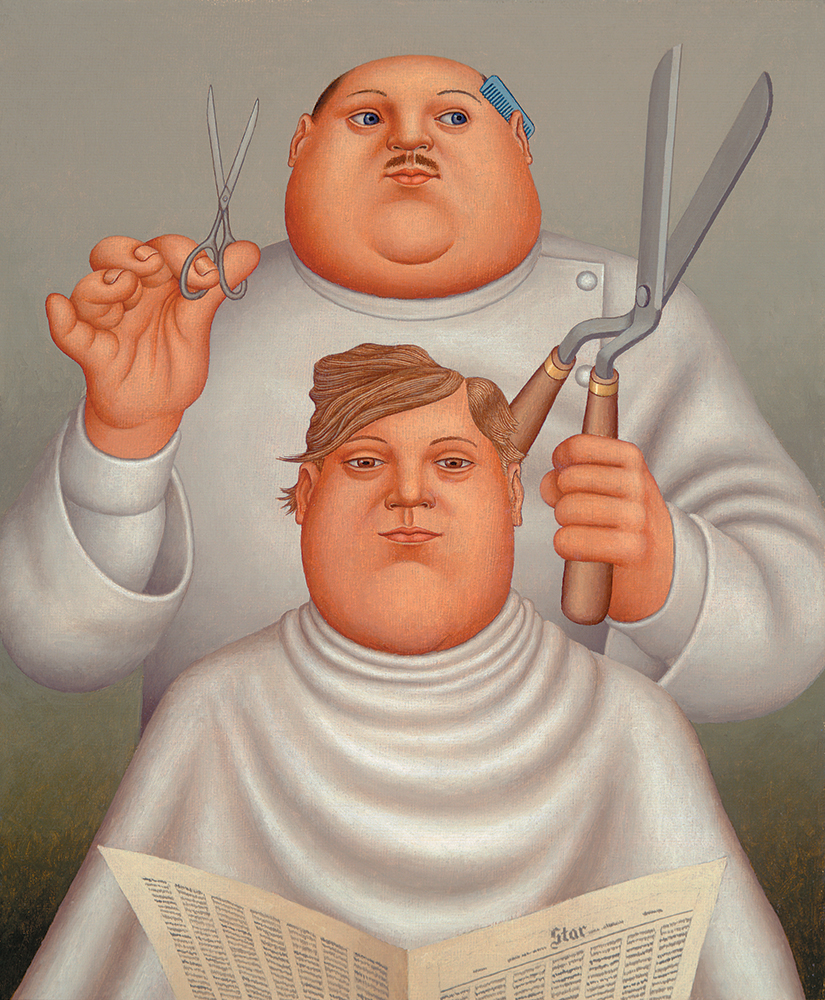

Where’s the precision in that, asks Perry? “Managers are using a machete when they should be using a scalpel.”

“Certainly a job is not an entitlement,” he emphasizes, “and I don’t think it’s even healthy to view employment that way. But it’s also just a little too easy for managers to solve their problems by laying off a lot of people. Yes, you have a fundamental responsibility to stockholders, but you also have a fundamental responsibility to those people who have been making money for stockholders for the last several years.”

Perry also recognizes that the real villains of downsizing are rarely ever mentioned: the kingdom builders. “These are the managers who build kingdoms before a company is ready for them. So they find jobs for people that do not add value, and these jobs then get eliminated. Bureaucracy is something managers create.”

Has downsizing thwarted this?

“That depends,” says Perry, “on how a company has downsized. If it has just made across-the-board cuts as a sort of mid-course correction, that breeds a natural backslide. It hasn’t fundamentally changed how the work is done in the organization. So if all an organization does is cut 10 percent, it is still using inefficient processes–people are just having to work harder. This creates natural forces that lead managers to balloon up their employment again.”

What really needs to happen, he says, is a “restructuring,” which involves not just size reductions but changes in processes and relationships. “The idea is that you’re cutting out nonessential work, not people. Employees tend to rally around this attitude, even if eventually you have to lay people off. At least they know it wasn’t a knee-jerk response; it wasn’t your first option.”

Even with restructuring, says Perry, there is always going to be a tension between what is good for society and what is good for business. “We can take the extreme economic approach that would ask managers to only answer to the bottom line or the humane approach that would just as soon see a business go down as lay anybody off–but these are only half answers. What managers need to start asking is, ‘If organizations could bring the goals of business and society together, what would they look like?’

“Having people gainfully employed and doing productive work is one solution to bringing these goals together. This is because increased resource utilization is good for both business and society. That doesn’t mean downsizing is out of the picture, but the Al Dunlaps would be. At least, that’s one step in the right direction.”