It’s official: we’re in a recession. BYU econ professors explain how we got into this mess—and what we can learn from it.

It’s official: we’re in a recession. BYU econ professors explain how we got into this mess—and what we can learn from it.

It’s official: we’re in a recession. BYU econ professors explain how we got into this mess—and what we can learn from it.

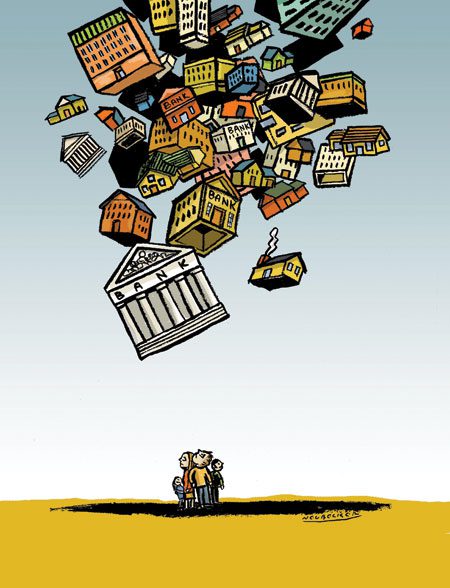

If you slept through Econ 110 or never took it—like the editors and designers who produce this magazine—it’s likely that recent economic turmoil has had you both shaking and scratching your head. Mortgage-backed securities? Subprime lending? Toxic assets? And your questions don’t end there. How did this mess happen? And what does it mean for me? You try to read the newspaper and magazine articles, but it’s all a bit (or a lot) over your head.

BYU Magazine turned to a handful of BYU economists for a layman’s explanation. Here is what we learned: four lessons in Financial Meltdown 101 (along with a glossary) for all of us who carefully scheduled ourselves out of economics.

NOTE: Some words have their glossary definition listed at the end of the article. They are the bolded terms throughout the text.

Lesson 1: Subprime Mania

Until the late 1990s, getting a home loan was no easy thing. You had to put up a sizeable down payment, prove your income, and have good credit. If you could do these things, you were considered a prime borrower—one at minimal risk of defaulting on your mortgage.

But these requirements also shut the doors to home ownership for many Americans—the subprime borrowers. BYU economics associate professor Mark H. Showalter (BA ’86) says this didn’t sit well with some politicians, who led a late-’90s charge to relax lending practices. “There was a very active legislative effort to expand home mortgages to people who banks traditionally hadn’t been loaning to,” he says. The result was a bevy of new loan products—from interest-only mortgages to mortgages for 100 percent of the house price—aimed aggressively at former house-have-nots (“Nothing down? No problem!” “Bad credit? No problem!”).

Suddenly, Americans of all economic strata could get home loans. Easy financing increased the demand for housing, and home prices shot into the stratosphere. Enthusiastic builders followed the money, constructing residential housing at a booming pace, which increased the supply of housing available. In their dizzying ascent, houses came to be seen as a sure-thing investment (cue the alarm).

Subprime borrowers, starting with little or no equity, expected equity to come easily as home values rose. Additionally, many subprime borrowers took out adjustable rate mortgages (ARMs), with rates that started low but, once adjusted, were way over their ability to afford. With a booming housing market, many planned to “flip” their houses before their rates adjusted, thus paying off their loans and turning a handsome profit. It all works great, so long as house prices keep rising.

And house prices always go up, right? Right? “Everyone was unduly optimistic about house prices,” says economics professor James R. Kearl. He says the various players in the housing equation should have known better. “House prices can’t go up faster than incomes for long periods of time. Otherwise, all of us [end up spending] all of our incomes on housing.”

At its peak, the housing bubble featured a surplus of expensive houses—with correspondingly large mortgages that were stretching the incomes of the consumers who were supposed to make payments on them. The next wave of homebuyers were not buying—or simply couldn’t afford—such overvalued properties. Demand declined, formerly hot real-estate markets turned cold, and the bubble as we knew it popped, causing house prices to plunge. As ARMs began adjusting, millions of consumers found themselves in mortgages they couldn’t afford and in homes they couldn’t sell at a break-even price.

Homeowners began defaulting on loans en masse, leading banks to tighten up lending practices. This, in turn, made it harder for subprime borrowers to refinance into more affordable mortgages, exacerbating the spiral of default. And then a new reason for default was born—one anticipated by almost nobody: underwater homeowners who could afford to make payments realized that they owed more than their homes were worth and began to simply walk away from their mortgages.

“In many cases, people could make the payments,” says Kearl, “but it didn’t make any economic sense.” By walking out on their mortgages, this group of defaulters forfeited their good credit rating but saved thousands of dollars. And in today’s sea of defaulters, Kearl says a bad credit score may not have the same repercussions that it used to.

How homeowners, banks, and the U.S. government will deal with these challenges remains to be seen, but Kearl says one outcome is already manifesting itself: “a movement back to more traditional mortgages in which individuals have to put something down on the house.”

Lesson 2: Mortgage-Backed Insecurity

In the olden days, when you wanted financing for a house, you worked out a deal with a bank, which issued, held, and serviced a mortgage. You made payments to the bank until the loan was paid off. What’s different today is where the payment goes when it leaves the homeowner’s hands.

Kearl explains that, starting in the 1960s and ’70s, secondary institutions like Fannie Mae and Freddie Mac bought up mortgages from banks, giving banks needed capital and taking on both the profits from interest and the risk of default. These mortgages, packaged in bundles of up to 1,000 or more as mortgage-backed securities (MBS), were then sold to investors who put up money for all or, often, just a slice of the bundle. This slicing meant that each mortgage in the bundle could be part-owned by hundreds of different investors.

Investors in these securities—from investment banks to private investors to the central banks of countries around the world—weren’t naive about the potential for default. They expected a small percentage of the mortgages in their slice to go belly up (typically because of the borrower’s loss of job, disability, or death). But these were considered manageable risks that were offset by an insurance tool called credit default swaps. The clincher, says BYU assistant professor of economics Richard W. Evans (BA ’98), came when rating institutions such as S&P and Moody’s stamped the securities with AAA risk ratings, the gold standard in investment safety. Institutions all over the world invested with confidence in U.S. mortgage debt—and from 1997 to 2007, there was plenty of it.

But when housing prices turned south in 2007, a tsunami of defaults followed, leaving holders of MBS the world over with securities that suddenly didn’t feel so secure. And because most of these securities had been sliced and diced into hundreds of pieces, says Kearl, it wasn’t clear which investors held the bag for the unexpected defaults.

With that uncertainty, the value of institutions that held large amounts of these “toxic assets” came into question, and their shares plummeted. Investors rushed to pull out their deposits or to collect insurance from their credit default swaps, and, in a moment, titans of Wall Street—like highly leveraged Fannie Mae, Freddie Mac, Lehman Brothers, and AIG—were brought to their knees. Toxic indeed.

Lesson 3: A Frozen Credit Market

It takes the fall of just one major financial institution to get the attention of just about everyone—from your average consumer to the variety of players in the world’s financial markets. And they all ask similar questions: Who, if anyone, is next? and How safe are my assets?

Uncertainty about these questions leads to a very reasonable gut reaction by investors (be they consumers or institutions), who want to make their assets as safe as possible. “People get nervous about their financial institutions and start moving their deposits around,” says Kearl.

That tendency leads to another gut reaction—this one by the lending institutions on the other side of the equation. They know that if enough of their clients feel worried and pull out their deposits, they could be leftinsolvent. Not wanting to be the next casualty, these financial institutions pool capital by lending less—to the consumer and to each other.

In 2008 these reactions were compounded by uncertainty about the liquidity of MBS-related assets. Because these assets are dependent on mortgage payments, says Kearl, their value is uncertain as defaults continue to rise. “It’s hard for financial institutions to be in the lending business,” says Kearl, “because they don’t know what they have to lend, what their assets are.” Showalter notes that this same uncertainty makes financial institutions wary of lending to each other, fearing that borrowing institutions won’t be able to make good on loans.

Uncertainty, distrust, worry—these are icy blasts to the flow of money upon which market economies depend. By early October 2008, as the demise of massive financial institutions was reported almost daily in newspaper headlines, the flow of capital was glacial at best.

Economists measure financial-market frostiness with a figure called the TED spread. A typical spread, 0.5 percent or less, represents a good flow of capital throughout the economy. The higher the spread, the poorer the flow. On Oct. 10 the spread was a record 4.65 percent. Think molasses in winter. Evans calls the October unwillingness of banks to lend “especially acute,” noting that it had “gone from acute to really bad.” And what’s really bad for banks is really bad for consumers.

Frozen credit markets ice up the stream of credit available to everybody else for the day-to-day functioning of the economy. “It’s not that banks don’t have [capital],” says Kearl. “The federal government is just having a hard time getting them to lend it because of the risks.” The economists are united in their forecast: we shouldn’t expect a considerable thaw until house prices quit tumbling and default rates quit mounting.

Lesson 4: What’s a Government to Do?

Imagine a structure has been built for the benefit of many people. Unfortunately, it has been discovered that this structure has a fundamental, irreparable flaw that makes it likely to collapse. What do you do? Do you prop it up, avoiding short-term loss but perpetuating inefficiencies? Or do you let gravity go to work, then clear away the rubble and build anew?

If the structure is a part of the economy and you are the typical economist, your answer will likely be the latter, says Showalter. While government aid to a faltering automotive or construction sector, for instance, might provide short-term relief and maintain jobs, it may also allow those industries to continue limping along without solving their problems. It’s better, Showalter likes to tell his Econ 110 students, to let the market forces do their work.

But Showalter says that even the most steely-eyed economist flinches a bit when the structure in danger of total collapse is the financial sector. “The financial system is crucial,” he says. “If you shut down the credit market, you’re shutting down the whole economy.” Even avowed libertarians have argued that, in this case, government intervention may be a necessary evil.

In an October 2008 panel discussion at BYU on the crisis and the U.S. government’s bailout plan, economics professor David E. Spencer (BA ’71) told students, “There are many risks associated with the plan, but there are even more substantial risks associated with doing nothing.”

Well, the U.S. government and its counterparts around the world can hardly be accused of doing nothing. With the goal of getting lenders lending and spenders spending, they’ve used just about every tool they have. The most common government intervention in the U.S. market—during good times and bad—comes in the form of adjustments to the monetary policy of the U.S. Federal Reserve. When credit is hard to come by, the government buys treasury bonds held by banks, which puts more cash into the system and makes banks more comfortable lending.

Another approach is to stuff money directly into the pockets of consumers and businesses. But Kearl says such stimulus packages have a mixed record. “The [$100 billion] bailout package that went through in February [2008] was trivial relative to the size of the economy,” he says. “And how well do they work? Not as well as you think because not everyone goes out and spends the money.”

When it became clear the economy was careening toward collapse despite these measures, the government pulled out the big guns. In March 2008 it orchestrated the sale of faltering investment bank Bear Stearns. In September it fully federalized Fannie Mae and Freddie Mac. And it provided a rescue package of some $150 billion for the massive AIG, which had insured MBS by selling credit default swaps.

And it was just getting started. With the approval of Congress, the Treasury and Federal Reserve obtained permission to invest $700 billion in the financial system. More than a month later, the Fed pledged to invest an additional $800 billion. The goals of these massive allocations seemed clear-cut: restore liquidity and public confidence, stabilize mortgage defaults, and keep credit markets functioning. However, the plan to reach those objectives continues to evolve.

The Treasury and the Fed have selected various methods to infuse their billions into the cash-strapped financial system—hoping to get banks and institutions lending again. Those methods include buying stock in financial institutions and purchasing MBS and other securities.

Meanwhile, economists are stewing over the second half of this “necessary evil.” A major concern is moral hazard, the law of unintended consequences at work. “The U.S. government, which claimed that it would not intervene, has now given evidence that it will intervene,” Kearl noted at the economics forum.

What happens at the next crisis?” Economists predict that huge financial institutions will be more likely to take big risks because they have reason to expect the government will step in if things go badly. “The only way to [restore the government’s credibility],” Kearl said, “is, in a milder crisis, to let everybody go down.”

Economists also fret over the effect of increased regulation on the market. Evans, like many economists, feels that, in most cases, the market can work out its problems. “There really is a power in the market system and prices.” But for now, most economists are watching how things play out. “One thing we know,” said Spencer at the forum, “even if it works exactly as [Fed chairman] Ben Bernanke and [Treasury secretary] Henry Paulson hope, the economy is going to suffer a lot of pain. We’re in a mess, and it’s going to be costly to get out of it.”

Where Wall Street and Main Street Intersect

After lawmakers passed the bailout package, Kearl remembers seeing “this kind of euphoria: ‘Well, we seemed to have solved that.’” But he says economists were shaking their heads. “The shock of the first round is going to create a second-round effect, which is a pretty serious recession.”

The economists’ suspicions were confirmed in December 2008, when the National Bureau of Economic Research (NBER) declared the U.S. economy had been in a recession for a full year. Formally, the NBER defines the R word as “a significant decline in economic activity spread across the economy, lasting more than a few months.” Informally, it means a steady stream of bad news for Joe Consumer of Anytown, USA.

So how is Mr. Consumer affected by all this? In a multitude of ways, says Evans. First off, a glut of large, unfilled homes on the streets of Anytown has caused Joe’s home to significantly decline in value. “If he wants to move,” says Evans, “he takes a big hit in wealth.” He’s also affected by banks’ unwillingness to lend money. “Joe can’t borrow as easily now [if] he wants to expand his house or put his kids in college.” And if Joe can’t obtain credit for such goals, he’ll be spending less at the businesses of Anytown.

Unfortunately, Joe’s fellow Anytownians are feeling similar pressure to penny pinch. This means decreased profits for Joe’s employer, the local seller of widgets. And like Joe, the company has found credit harder to come by. In the past the company has depended on loans for everything from purchasing widget components to paying its employees. “Businesses have to be able to finance their ongoing activities,” says Kearl. “Debt for a business is a good thing.” As profits decline and loans become scarce, Joe’s company begins laying off employees.

On top of all this, Joe is seeing the value of his retirement savings and other investments shrink by the day as stock markets slide. So you can’t blame Joe for feeling a little depressed during these hard times. And hard times, say the economists, are inevitable until the market corrects itself and house prices stabilize. “There’s no way to get around this without some pain,” says Evans. “You can’t just reverse this giant misallocation [of resources].”

But the economists can provide Joe and the rest of us with some reassurance. “Economies go through cycles, and this is a downward cycle,” says Showalter. “These are things that happen in capitalist societies, and they end at some point.”

Kearl expects that it’s just a matter of time—and wise adjustments to the system—before the economy rebounds. He notes that the United States still has sturdy infrastructure, a highly trained workforce, and lots of capital. “Underlying this [crisis] are all the attributes of a well-functioning economy, and they’re going to come back to the fore.”

GLOSSARY

Subprime: Subprime borrowers have a lower credit rating (from lack of capital, loan delinquency, or limited debt experience), which puts them at a higher risk of default in the eyes of lending institutions. Subprime loans usually start at a higher interest rate, or start at a low interest rate for a fixed time period before adjusting to a much higher interest rate.

Demand: The amount of a good or service that consumers are willing to purchase at a particular price.

Supply: The amount of a good or service that producers are willing to sell at a particular price.

Flip: An investment strategy in which consumers buy a home, hoping to sell it quickly and make a profit on the home’s increase in value.

Underwater: The situation of owing more on a mortgage than a home is worth.

Mortgage-backed security: A complicated financial tool through which investors—not banks—own home mortgages. Banks sell the mortgages to investment institutions. Investment institutions sell the mortgages, in pieces, to investors. Investors receive the principal and interest paid by homeowners. Selling mortgages gives banks more capital, allowing them to offer more loans, and the cycle repeats.

Investment banks: Unregulated financial institutions dealing in securities, mergers and acquisitions, and other financial services. Unlike commercial banks (which mainly deal in consumer banking), investment banks were not FDIC insured and had no required reserve. Tending to be highly leveraged, several investment banks failed in the subprime lending crisis. Every major investment bank has now converted into a commercial bank or merged with one.

Credit default swaps: A complex insurance tool in which the buyer makes a series of premium payments and receives a payout in the event that a given financial instrument defaults. These were widely used as protection against MBS risk.

Toxic assets: A popular term used to describe MBS and related assets of questionable value. Because their value became uncertain in the crisis, these assets could not be used to meet financial obligations.

Leverage: The common practice of financial institutions to reinvest borrowed money to make profit, expressed as a ratio of dollars invested to dollars available in liquid assets. Federally insured banks cannot be leveraged more than 10–1, while investment banks and other non-regulated institutions have no restriction (Lehman Brothers was leveraged 30–1; AIG, 60–1). Leveraging increases both the chance for profits and the risk of failure in a crisis.

Insolvent: The state of being unable to pay debts.

Liquidity: A term describing how easy or difficult it is for individuals or institutions to use their assets to meet financial obligations. Cash, for instance, has high liquidity. Money tied up in assets, on the other hand, may have lower liquidity; to access that money, one must first sell the asset or secure a loan using the asset as collateral. In 2008 MBS assets became illiquid, meaning that institutions that held MBS could no longer trade or sell them.

TED spread: A figure that measures the difference between the going rate for U.S. treasury bills, considered the lowest-risk investment, and the LIBOR rate, a measure of the rates at which banks are willing to lend to each other.

Monetary policy: A central bank’s approach to influencing the economy (for instance, to limit inflation or increase spending) through increasing or decreasing the availability of money.

U.S. Federal Reserve: The central bank of the United States, commonly called the Fed. Among its main roles are providing a reserve against bank panics and managing inflation and interest rates through monetary policy.

Moral hazard: The tendency of implied or guaranteed protection to lead an individual or organization to engage in riskier behavior than they would without the protection.

Recession: A period of economic downturn that typically features an increase in unemployment and a decrease in income, retail sales, and gross domestic product.

Feedback: Send comments on this article to magazine@byu.edu.